Trump's Shock Move: A CBDC Ban and Bitcoin's Rise to Power?

President Trump's recent executive order is sending shockwaves through the financial world, banning CBDCs and potentially boosting Bitcoin's global dominance. Is this a bold step towards a new digital frontier, or a risky gamble with unpredictable outcomes? Find out now!

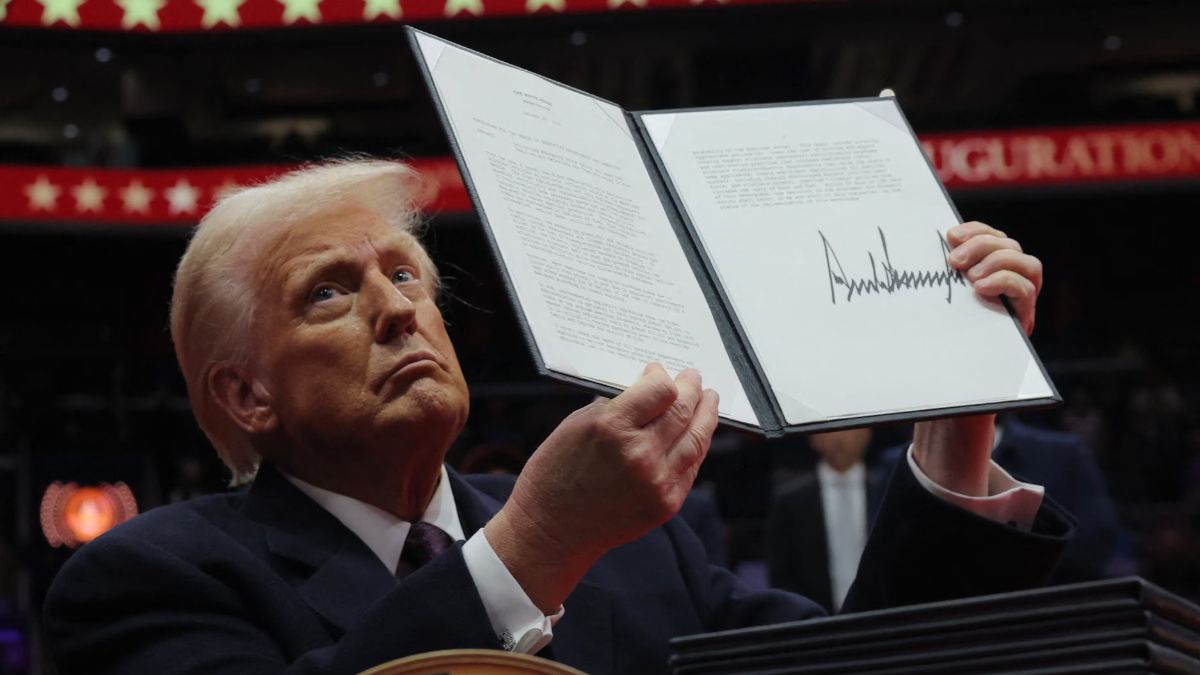

The Executive Order: A Digital Asset Revolution?

The executive order, titled "Strengthening American Leadership in Digital Financial Technology," is not just another regulation; it's a game-changer. Its centerpiece is a definitive ban on the creation of a central bank digital currency (CBDC) within the United States, sending a clear message that President Trump prioritizes digital assets that challenge the current centralized monetary system. This groundbreaking decision is already sparking international debate, influencing how other nations might consider CBDC implementation. What implications will this bold move have for global digital finance? Could it usher in a new era of decentralized finance, placing the US at the forefront of crypto innovation?

Decoding the CBDC Ban: What it Means

The ban isn't just symbolic. It halts all government efforts to develop, promote, or issue a CBDC. This directly contradicts the approaches of many other countries actively exploring their own digital currencies. Is the US willing to sacrifice a potential competitive edge by taking such a decisive stand against CBDCs? It's crucial to see how this contrasts with the global landscape, with nations developing their own versions and their potential impact on the US economy.

The Presidential Working Group: Shaping the Future of Digital Assets

The order also creates a presidential working group, tasked with developing a regulatory framework for the volatile landscape of digital assets. The group will look into the potential formation of a national digital asset reserve—a controversial idea with potentially vast implications for the government's role in financial markets. In particular, President Trump's interest in creating a strategic Bitcoin reserve will undoubtedly shape the group's approach and further shape the nation's relationship with crypto.

Trump's Bitcoin Vision: A National Strategic Reserve

Trump's support for cryptocurrencies has been widely publicized. His proposed strategic Bitcoin reserve—using Bitcoin seized from criminal activity—is particularly bold, drawing inspiration from similar legislation such as the one introduced by Senator Cynthia Lummis. The proposition, should it be enacted, to add 200,000 Bitcoin to the reserves each year will catapult the US to the leading position globally in Bitcoin ownership, setting a precedent for other governments considering a similar approach to building up a reserve of Bitcoin or other prominent crypto assets.

The Strategic Implications: Why This Matters

The creation of a strategic Bitcoin reserve has the potential to massively influence the cryptocurrency market. The acquisition and holdings will have a notable impact on the price volatility, generating much greater stability than the current, fluctuating market. Many have expressed concern that a significant government role may impact the very concept of a decentralized currency, while others believe that large scale adoption by governments such as the US might introduce a positive measure of stability.

The Ross Ulbricht Pardon: A Symbolic Gesture?

Adding another layer to this cryptocurrency revolution, Trump also granted a full pardon to Ross Ulbricht, the founder of Silk Road. This action, fulfilling a campaign promise, can be interpreted as a clear indication of support for the cryptocurrency community and a belief in the possibility for cryptocurrency to be reformed in a manner that promotes integrity.

Signaling Acceptance: Cryptocurrency in the Mainstream

The pardon extends beyond a mere act of clemency. It is seen as a symbolic acceptance of the decentralized financial revolution occurring around the world. The decision adds to President Trump's legacy, one where the government supports the blockchain sector, the creation of crypto assets, and aims to protect against harmful regulations that may hinder the progress of this evolving technological environment.

What Does This Mean for the Future?

Trump's actions place the United States at the center of the digital asset conversation. The implications of the executive order ripple beyond US borders. Will other nations adopt similar strategies or pursue their own paths? What impact will a US Bitcoin reserve have on the global cryptocurrency markets? This is not just a policy shift; it could mark a fundamental shift in the power dynamics of the digital currency landscape. By acting on the existing momentum of crypto use in illicit trade to convert Bitcoin, obtained through illegal practices, into the backing for a strategic reserve, the future of crypto adoption and regulation will depend upon how quickly other nations may react and adopt these measures for their own benefit. This remains a highly contested and rapidly changing regulatory environment, therefore, this bold approach of creating such a reserve may signal a new trend for governments, which, despite regulatory restrictions, may see the benefit in utilizing such approaches to generate significant profits from existing crypto resources.

Long-Term Impact on the Digital Asset Landscape

The interplay between President Trump's executive order and the government's strategy concerning cryptocurrencies are already generating significant interest internationally. The success or failure of the initiatives outlined within the order will be closely scrutinized, as such changes directly impact the regulation and use of decentralized technologies.

Take Away Points:

- President Trump's executive order effectively bans CBDCs in the US.

- A presidential working group will be crucial in forming a regulatory framework for digital assets, including a potential Bitcoin reserve.

- Trump's pardon of Ross Ulbricht signifies his support for the cryptocurrency community.

- The executive order's global implications will shape future digital asset policy across nations.