Google Pay is expanding its UPI capabilities with the introduction of several new features aimed at making digital payments more accessible and user-friendly in India. These features include Delegate Payments, UPI Circle, Prepaid UPI vouchers, ClickPay QR support, Tap & Pay for RuPay cards, and Autopay for UPI Lite users. These updates address existing limitations and create a more inclusive digital payment environment for a wider audience.

Empowering Financial Inclusion with Delegate Payments

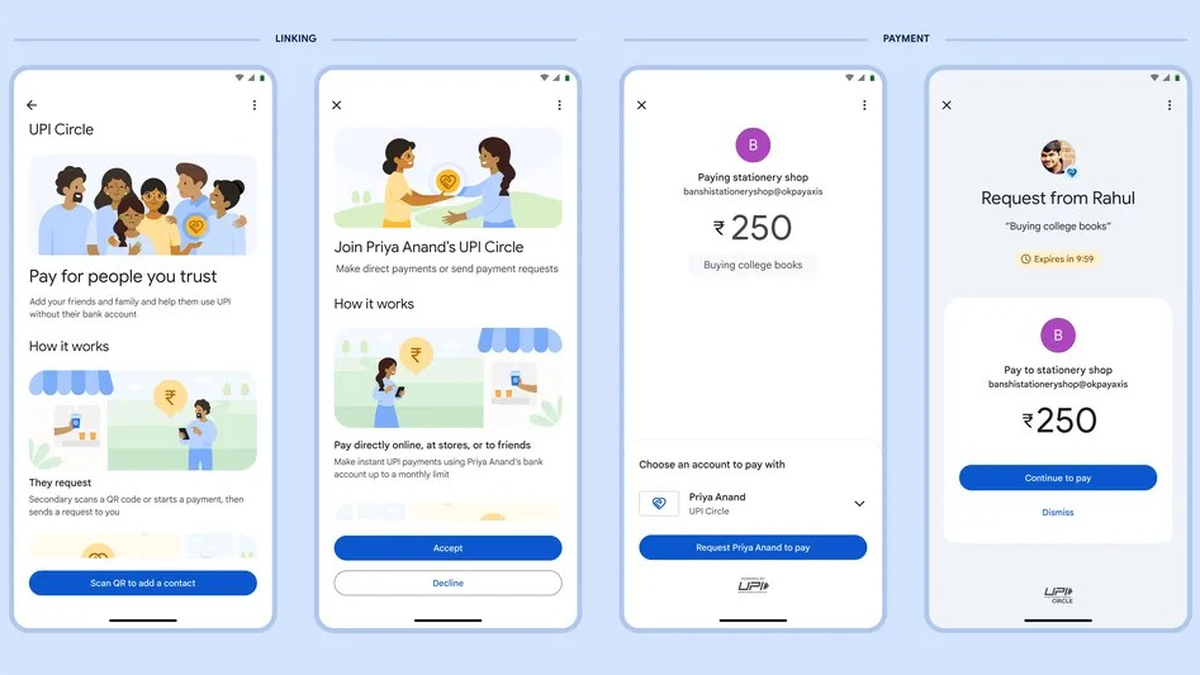

The introduction of the Delegate Payments feature is a significant step towards financial inclusion. This allows primary users to empower secondary users, such as family members or close friends, to make UPI payments without needing their own bank accounts. This can be particularly beneficial for individuals who may not have access to banking services or are hesitant to use UPI. The Delegate Payments feature comes in two formats:

Partial Delegation:

This option gives the primary user complete control over the payments made by the secondary user. Every payment request initiated by the secondary user needs the approval of the primary user, ensuring a high level of security and control. This is ideal for situations where the primary user wants to guide and supervise the secondary user’s transactions.

Full Delegation:

This option grants greater independence to the secondary user while still providing safety measures. The primary user can set a monthly limit, up to ₹15,000, for the secondary user. This allows the secondary user to make independent payments within that limit, offering a level of convenience and autonomy.

Expanding Payment Options with Prepaid UPI Vouchers

The introduction of Prepaid UPI vouchers further enhances Google Pay’s offerings. These vouchers enable users to pay for merchant transactions using any supporting UPI app without linking their bank account. This feature caters to users who might be uncomfortable with linking their bank account or prefer to use a prepaid system for greater control over their spending. The flexibility of these vouchers opens up a new world of possibilities for both users and merchants, encouraging a wider adoption of digital payment methods.

Seamless Bill Payments with ClickPay QR

Google Pay, in collaboration with NPCI Bharat Billpay, has incorporated ClickPay QR support into its platform. This feature allows users to pay their bills easily by scanning a QR code displayed on their bills. It eliminates the need for manual bill payment methods, simplifying the process and ensuring timely payments. This integration underscores Google Pay’s commitment to streamlining user experience and making bill payments effortless.

Expanding Payment Ecosystem with RuPay Cards & Tap & Pay

Google Pay’s integration with RuPay cards signifies a major development in its payment ecosystem. The ability to add RuPay cards to the app and pay using the Tap & Pay feature allows users to seamlessly utilize their existing cards for purchases. This feature emphasizes inclusivity by catering to a wide range of users and their preferred payment methods. The added security of not storing the card information on the platform ensures peace of mind for users, fostering trust and encouraging adoption.

Simplifying Payment Processes with UPI Lite Autopay

Google Pay is implementing Autopay for UPI Lite users further enhancing user convenience and simplifying recurring payments. This feature enables UPI Lite users to automate recurring payments, such as utility bills or subscriptions, eliminating the need for manual actions. It provides a more streamlined payment experience, freeing users from remembering and managing recurring payments. This advancement reflects Google Pay’s dedication to continuous improvement and innovation in the realm of digital payments.

Take Away Points

Google Pay’s new features showcase a strong focus on driving financial inclusion, user convenience, and secure digital payments. The inclusion of Delegate Payments, Prepaid UPI vouchers, ClickPay QR support, and Tap & Pay for RuPay cards expands the reach of digital payments and offers more flexibility and choice for users. By implementing these features, Google Pay is actively creating a more inclusive and user-friendly digital payment ecosystem in India, facilitating a seamless and secure transition to a cashless society.