Google Pay is expanding its features with a focus on financial inclusion and convenience. During the Global Fintech Fest (GFF) 2024, the platform announced several new initiatives designed to make digital payments accessible to a wider range of users, including those without traditional bank accounts. These innovations, centered around UPI Circle, prepaid UPI vouchers, ClickPay QR, and Tap & Pay for RuPay cards, are poised to significantly shape the future of payments in India.

Simplifying UPI with Delegate Payments

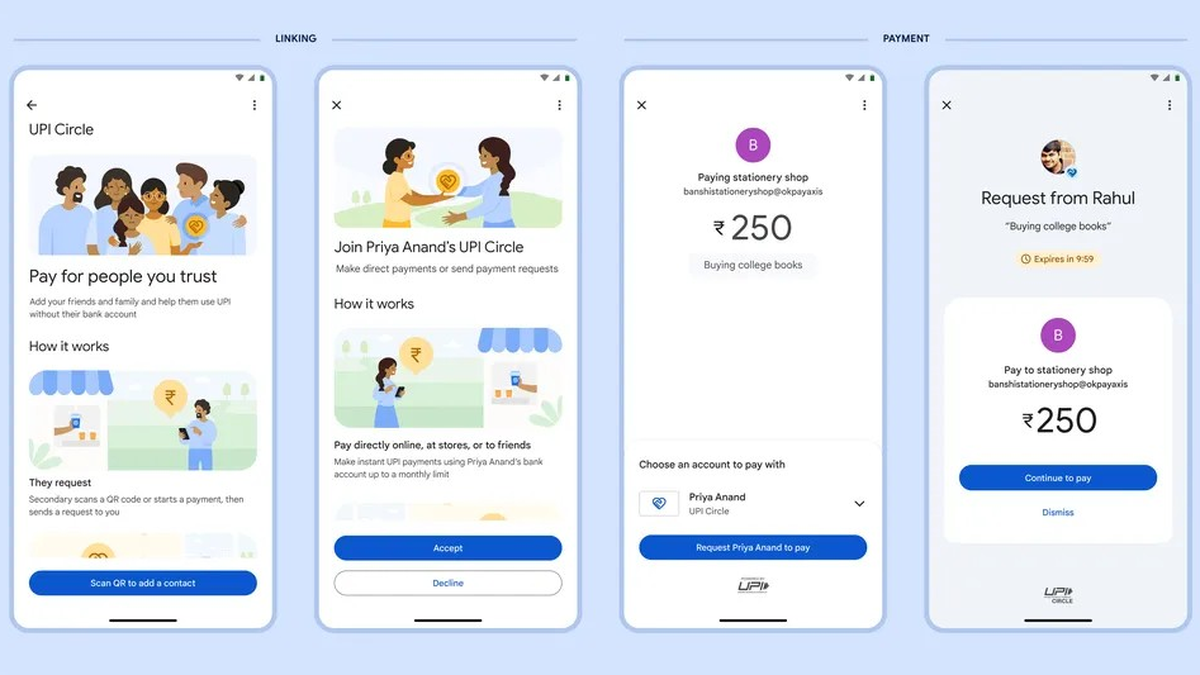

Google Pay’s newest feature, UPI Circle (Delegate Payments), aims to bridge the digital divide by enabling users to make UPI payments without directly linking their bank accounts. This feature is particularly beneficial for individuals who may not have access to traditional banking services or are hesitant to use UPI. The UPI Circle allows users to add their family members or friends as secondary users, thereby extending their payment capabilities to those who might not be comfortable with the process.

Two Levels of Delegation

To ensure safety and control, UPI Circle comes in two distinct modes:

- Partial Delegation: In this mode, the primary user maintains complete control over transactions, approving each payment request initiated by the secondary user. This level of control is suitable for situations where the primary user wants to closely monitor the transactions made by their delegate.

- Full Delegation: This mode offers a higher level of autonomy, allowing the primary user to set a monthly limit (up to ₹15,000) for their delegate. Within this limit, the secondary user can make independent payments. Full delegation is ideal for trusted family members or friends who require a more self-sufficient payment experience.

Prepaid UPI Vouchers: Accessing Digital Payments without Bank Accounts

Google Pay’s commitment to financial inclusion extends beyond UPI Circle. The platform has introduced Prepaid UPI vouchers, enabling users to engage in merchant transactions without directly linking their bank account. These vouchers can be used across any UPI app that supports them, further increasing the accessibility and flexibility of digital payments. This initiative is especially crucial for individuals who lack access to bank accounts but still need to participate in digital transactions.

Enhancing Bill Payments with ClickPay QR

In a collaboration with the National Payments Corporation of India (NPCI) Bharat Billpay, Google Pay has introduced support for ClickPay QR. This feature enables users to conveniently pay their bills by scanning a QR code using the Google Pay app. This seamless integration simplifies the bill payment process and encourages wider adoption of digital bill payments.

Expanding Recurring Payments with Prepaid Utilities

Recognizing the growing demand for recurring payment options, Google Pay, in partnership with NPCI Bharat Billpay, is expanding its supported categories to include prepaid utilities. This allows users to conveniently manage their prepaid utility bills, discover providers and aggregators, and enjoy a more unified platform for recurring payments.

Tap & Pay with RuPay Cards for Contactless Transactions

Further bolstering its commitment to contactless payments, Google Pay, with NPCI’s support, has added Tap & Pay functionality for RuPay cards. This allows users to add their RuPay cards to Google Pay and make secure payments by simply tapping their phones on card machines. The secure payment process ensures that sensitive card information is not stored on Google Pay, prioritizing user privacy and security.

Autopay for UPI Lite: Simplifying Micro-Payments

Google Pay’s focus on improving user experience extends to UPI Lite, a feature designed for micro-payments. The introduction of Autopay for UPI Lite further enhances its convenience by automating recurring micro-payments. This reduces manual effort and ensures timely payments for subscriptions, services, and other recurring micro-transactions.

Take Away Points

- Google Pay is expanding its features to improve financial inclusion and user convenience.

- UPI Circle (Delegate Payments) will enable users without bank accounts to make UPI payments by delegating transactions to family or trusted friends.

- Prepaid UPI vouchers allow for merchant transactions without a linked bank account, promoting accessibility for those who lack traditional banking services.

- Support for ClickPay QR simplifies bill payments with easy scanning through the Google Pay app.

- Google Pay’s expanded support for recurring payments now includes prepaid utilities, further simplifying financial management for users.

- Tap & Pay functionality for RuPay cards provides a secure contactless payment experience for all RuPay cardholders.

- Autopay for UPI Lite further simplifies recurring micro-payments, streamlining transactions and saving time for users.