Are you a small business owner in the US? Get ready, because the Corporate Transparency Act (CTA) might just be about to change how you do business! This landmark anti-money laundering law aims to shine a light on shadowy dealings, but the implementation has been a rollercoaster, leaving many small business owners wondering: What does this actually mean for me? Let's dive into the twists, turns, and current status of this potentially game-changing legislation.

Decoding the Corporate Transparency Act: What You Need to Know

The Corporate Transparency Act, passed in 2021, is designed to tackle money laundering and the use of shell corporations for illegal activities. Sounds simple, right? The catch is, it mandates that millions of small businesses register personal information with the Financial Crimes Enforcement Network (FinCEN). This includes details such as your photo ID and home address, info many find invasive and problematic. Think of it as a big national "know your customer" initiative, but with stricter reporting requirements than ever before. Many business owners feel this is excessive regulation!

Why the fuss?

The main arguments center around the amount of paperwork required. Critics argue that the compliance costs could bankrupt many small companies. These increased administrative burdens might particularly impact women-owned small businesses and minority-owned small businesses who might lack resources. It has led many business owners to question its true effectiveness, leading to the current stalemate. The Supreme Court recently lifted an injunction, but other legal battles still leave the future uncertain.

The Legal Limbo: Supreme Court Decisions and Ongoing Injunctions

The journey of the Corporate Transparency Act hasn't been smooth. There has been a protracted legal battle against the implementation of the Act. Recent Supreme Court actions have had a huge ripple effect on the millions of small business owners nervously waiting to see if they'll need to comply. While one injunction has been lifted, another keeps the registration requirements in a holding pattern. As it stands now, the required information filing is not required. Does this provide immediate relief? Not necessarily, as the legal battles may continue to drag on, leaving small businesses in limbo. It's important to note, though, that submitting the relevant information voluntarily remains an option, and legal experts suggest this may offer some kind of protection.

Navigating Uncertainty

This ongoing uncertainty is a major headache for many small businesses. They must juggle their existing daily tasks with figuring out whether or not, or how best to, comply with the changing mandates. For many, the act itself seems unnecessarily complex, with too many small details and nuances.

FinCEN's Response and Future Implications

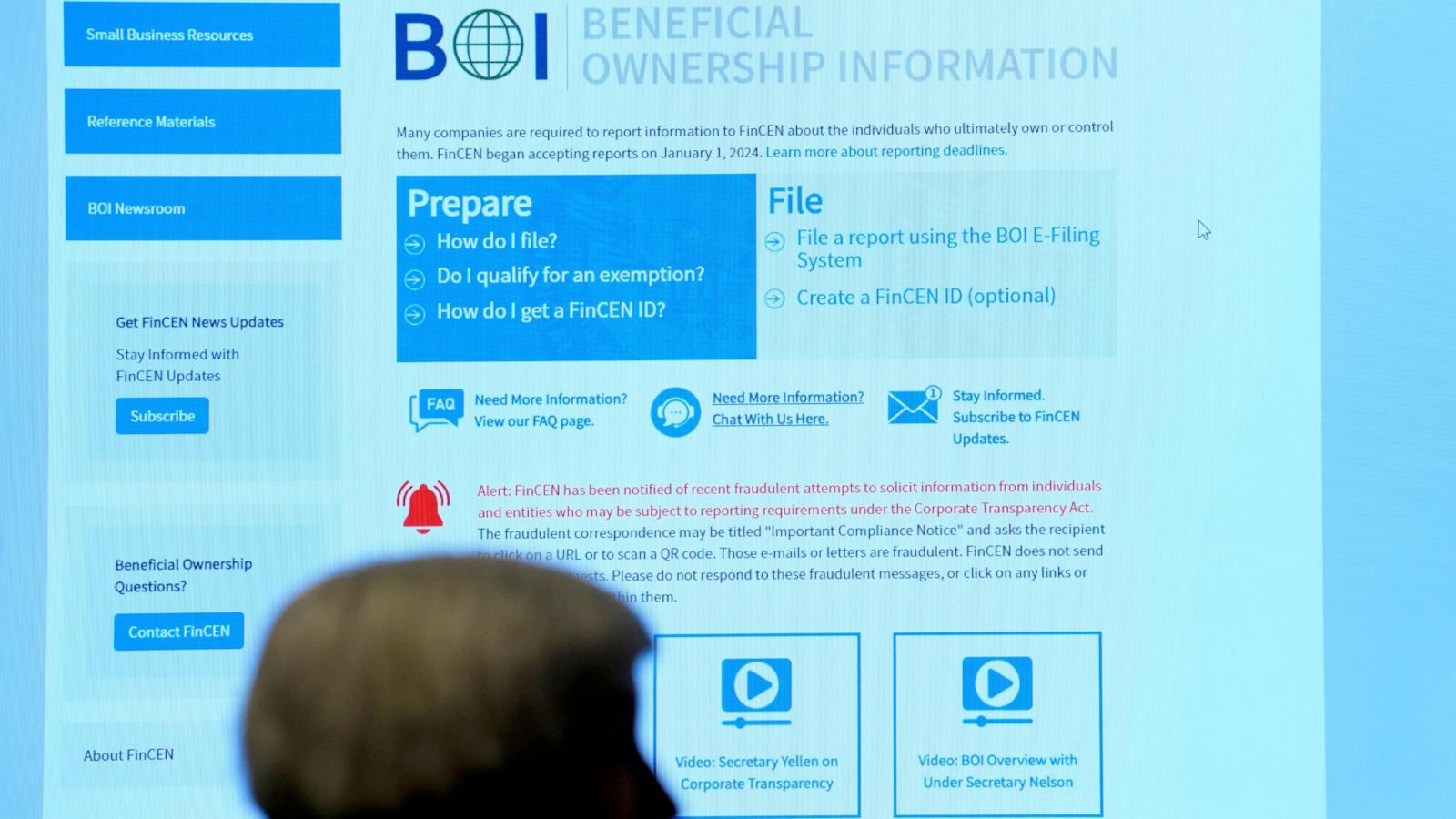

FinCEN, the agency responsible for implementing the CTA, has been fairly responsive throughout this entire process. On their official website, the organization explains the legal status and clearly indicates that as of this current time, no actions need to be made yet. This is welcome news to millions. That does not preclude business owners from choosing to voluntarily submit reports as they wait to see whether the regulations will officially be put into place. Even if registration eventually goes into effect, the level of enforcement is yet another question mark. The law's opponents and small businesses anxiously await a clearer picture of the future!

What lies ahead?

The act will impact different types of small businesses, both positively and negatively, based on how they conduct business. Some predict more regulations or even taxes targeting various activities will follow this initial registration.

Small Business Owners: Prepare for Action (Eventually!)

The future is uncertain, but responsible business owners should proactively research the finer points of the CTA. Keep an eye on FinCEN's website and legal developments closely for updates. It's wise to consider how compliance or noncompliance will affect business practices now and in the future. What does this mean for your financial reporting, internal controls, business strategies, and expansion plans? Planning ahead will be crucial.

Seeking guidance

This is not the time for uninformed decision making. Small business owners must consult qualified legal professionals. If small business owners lack sufficient resources to seek counsel themselves, various non-profit or government-based programs offer such support. By actively preparing and taking initiative now, you'll place your company in a far better position to move forward in any direction!

Take Away Points:

- The Corporate Transparency Act is aimed at curbing money laundering.

- Small businesses are not currently required to register (but can voluntarily).

- Legal challenges and ongoing injunctions have stalled the requirements.

- Staying informed is vital for business owners.

- Seek professional legal advice to prepare for future possibilities.